The Final Decision of Sam Bankman’s Trial Hearings, Let’s Find Out

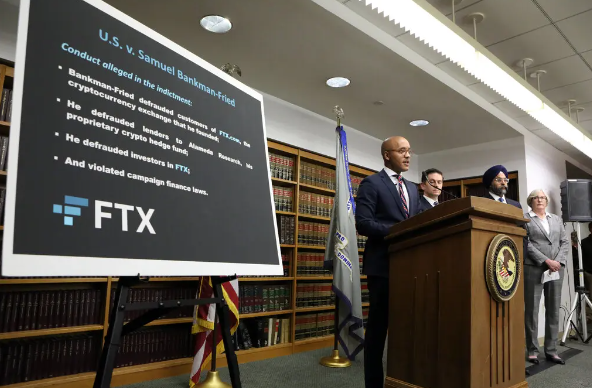

The recent conviction of Sam Bankman-Fried, the founder of FTX, on seven criminal charges related to the collapse of his crypto empire has raised significant questions about the potential length of his prison sentence. While the maximum sentence for these charges could be as high as 115 years, the final decision rests with Judge Lewis Kaplan, a seasoned judge known for his no-nonsense approach in the courtroom. So, hold onto your seats because this blog post is all about the final decision of Sam Bankman-Fried’s trial hearings. Sam Bankman’s Trial: The Jury Verdict and Its Implications A jury of twelve individuals found Sam Bankman-fried guilty of all seven criminal charges brought against him. This unanimous verdict suggests that the jury was genuinely convinced of his guilt, which leaves no room for further discussions. Moreover, Legal experts, such as Yesha Yadav, a law professor and Associate Dean at Vanderbilt University, argue that this overwhelming agreement should give Judge Kaplan the confidence to impose a more severe sentence. The verdict is a crucial starting point in determining the potential length of Bankman-Fried’s prison term. The Charges and Their Gravity The charges against Bankman-Fried include wire fraud, conspiracy to commit wire fraud, securities fraud, commodities fraud, and conspiracy to commit money laundering. The sheer scale of these charges and their associated penalties significantly impacts the potential duration of his sentence. The statutory maximum sentence for these charges is approximately 115 years, which sets the upper limit for his potential incarceration. Sentencing Guidelines and Judge Kaplan’s Discretion Despite the high statutory maximum sentence, federal sentencing guidelines offer a more nuanced approach. These guidelines consider various factors, including the scale of the crimes and the defendant’s criminal history. Experts anticipate that these guidelines will be “sky-high” due to the severity of Bankman-Fried’s fraud. However, it’s important to remember that these guidelines are just that—guidelines. Judge Kaplan possesses discretion to consider all circumstances surrounding the defendant and the offense. Renato Mariotti, a former prosecutor in the U.S. Justice Department’s Securities and Commodities Fraud Section, believes that Bankman-Fried’s sentence may fall within the range of 20 to 25 years, given the massive scale of his fraud and the judge’s limited patience for his behavior. Comparisons with Other High-Profile Cases: Bankman-Fried’s case has been compared to that of Elizabeth Holmes, the founder of Theranos, who was sentenced to over 11 years in prison for defrauding investors. However, the scale of losses in Bankman-Fried’s case far exceeds those in Holmes’s case, leading experts to liken it to Bernie Madoff’s, who received a 150-year sentence. Like Madoff, a significant portion of the losses in this case involved small investors, not just large institutions. This fact tends to exert more pressure for a substantial sentence. Nevertheless, there are differences, such as Bankman-Fried’s age, which may be taken into consideration. At 31 years old, he has more productive years ahead of him compared to Madoff, who was much older when he received his 150-year sentence. Potential Mitigating Factors: Despite the severity of the charges, there are certain factors that may mitigate Bankman-Fried’s sentence. One crucial aspect is the non-violent nature of his crimes. Unlike cases involving physical harm or violence, his offenses primarily revolve around financial misconduct. This factor could weigh in his favor during the sentencing process. Additional Charges on the Horizon: One wildcard in this case is the possibility of additional charges. The Department of Justice may bring a second set of charges against Bankman-Fried in March 2024, adding a layer of complexity to his legal predicament. The potential impact of these pending charges on the length of his sentence cannot be underestimated. The Upcoming Sentencing Hearing The final decision regarding Sam Bankman-Fried’s prison sentence rests with Judge Kaplan. The sentencing hearing is scheduled for March 28, 2024, at 9:30 a.m. ET. The judge’s task will be to impose a sentence that not only punishes Bankman-Fried for his offenses but also deters others from engaging in similar criminal activities. The principle of promoting respect for the law and the need to provide justice for the victims will also play a significant role in the judge’s decision. To wrap up: The future of Sam Bankman-Fried remains uncertain as he faces potential decades behind bars. The recent jury verdict, the gravity of the charges, and the sentencing guidelines all contribute to the complexity of his situation. While comparisons to other high-profile cases offer some insight, the unique circumstances surrounding this case, including the potential for additional charges, make it difficult to predict the exact length of his prison sentence. The sentencing hearing in March 2024 will be a pivotal moment in determining the fate of the FTX founder and the message it sends to the world of financial misconduct.