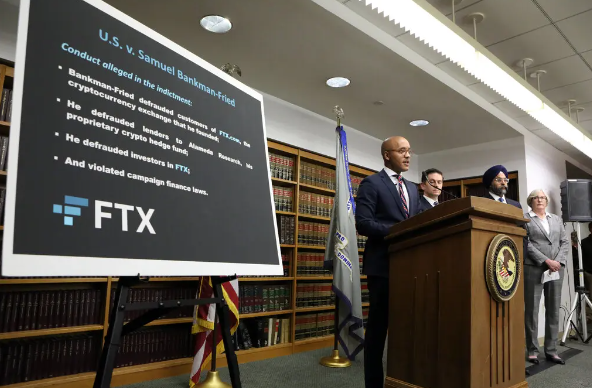

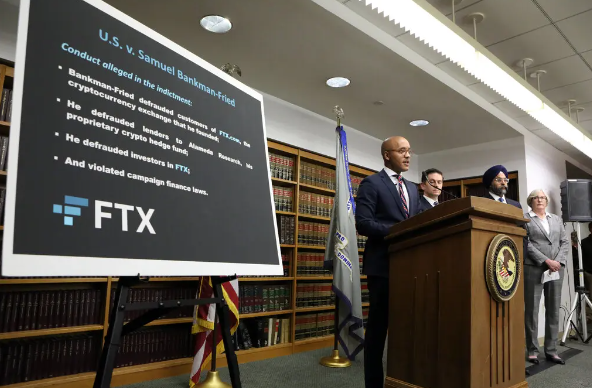

An Insider’s Look at the Biggest Fraud in Digital Financial History: FTX

The dramatic growth of FTX and its founder, San Bankman-Freed (known as SBF), was nothing short of extraordinary. In just three years, FTX went from

The dramatic growth of FTX and its founder, San Bankman-Freed (known as SBF), was nothing short of extraordinary. In just three years, FTX went from

Coin Informer is back with our Weekly news, discussing top news headlines of the crypto industry in an easy way. Like every week, this week

As every drop comes together to form an ocean, every technological achievement will someday result in a revolution. Cryptocurrency is one such enigmatic concept that

Who would have thought an individual who was once hailed as ‘The White Knight of Crypto’s would end up as a criminal in fraudulent activities?

Sam Bankman, a 31-year-old who once was famous as a Crypto king. Now, he has become a scandal himself. If we talk about scandal, Crypto

Welcome to the Cryptocurrency forecast, where Coin Informer will tell you about the latest happenings in the Crypto world. This post will guide you to

What’s up? All wonderful crypto enthusiasts. You must be waiting for our weekly Crypto Updates, and now, we’re here to shed light on the top

We all know about cryptocurrency, but do you know how and when it all started? Cryptocurrency has brought revolution in the financial world. However, this

According to reports, Valeria Fedyakina, a well-known personality in the crypto industry, is known as Bitmama. She is also famous by her name, “Queen of

Coin Informer welcomes you to the weekly crypto news update, where we bring you the latest news from the crypto world. From regulatory crackdowns in

Disclaimer: Coin-Informer is for informational purposes only and does not constitute investment advice. The content on this website is not an offer or solicitation to buy or sell any financial products. Rates, terms, and information presented on third-party websites are subject to change without notice. Coin-Informer may have financial relationships with some of the merchants referenced, and may receive compensation if users choose to utilize links on this site.

Disclaimer: Coin-Informer is for informational purposes only. This website does not provide investment advice, nor is it an offer or solicitation of any kind to buy or sell any investment products. Rates and terms set on third-party websites are subject to change without notice. Please note that Coin-Informer has financial relationships with some of the merchants mentioned here and may be compensated if consumers choose to utilize some of the links located throughout the content on this site.

Disclaimer: Coin-Informer is for informational purposes only. This website does not provide investment advice, nor is it an offer or solicitation of any kind to buy or sell any investment products. Rates and terms set on third-party websites are subject to change without notice. Please note that Coin-Informer has financial relationships with some of the merchants mentioned here and may be compensated if consumers choose to utilize some of the links located throughout the content on this site.