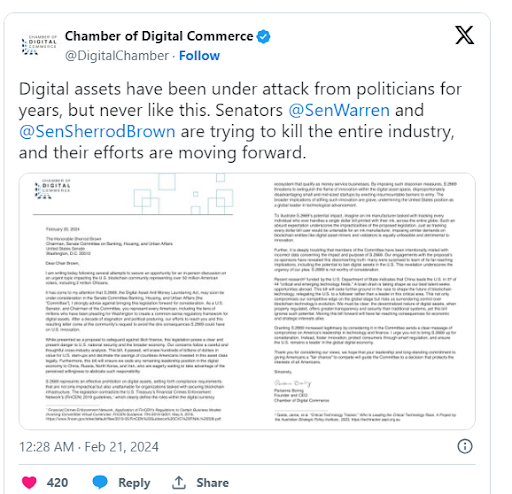

February 20, 2024. The Chamber of Digital Commerce (CDC), a renowned American crypto advocacy group, accused Senator Elizabeth Warren and Sherrod Brown (a Banking Committee) of trying to kill the crypto industry through the Digital Asset Anti-Money Laundering Act of 2023. Last year, when this act was re-introduced, the crypto industry made several efforts to oppose it. But now, with the CDC’s latest post on X, the attention on the Digital Asset Anti-Money Laundering Act of 2023 is back. So, let’s take an overview of this controversial act and see how it may kill the digital assets industry if passed. Moreover, let’s see what the CDC has done that has the attention of the entire crypto industry back on it.

An Overview of the Digital Asset Anti-Money Laundering Act of 2023

A Little Background of this Act

The Digital Asset Anti-Money Laundering Act was first introduced in the US Senate by Elizabeth Warren and Roger Marshell in December 2022. But, after continuous delay, the act was re-introduced on July 27, 2023, by the same Senators (Ms. Warren & Mr. Marshell), but this time, there were two cosponsors – Joe Manchin and Lindsey Graham.

What Led to the Proposition of this Act in the Senate?

The act came into life by due to the several warnings of the Treasury Department, the Department of Justice, and the Federal Bureau of Investigation In mind. All these national security organizations warned the administration of the rising cases where digital assets are being used for money laundering, terrorist financing, trafficking & other fraudulent crimes. Crypto criminals hidden in rogue countries like Iran, Russia & North Korea have stolen over $1.7 billion worth of digital assets in 2023 alone. According to official reports, around $20 million worth of digital assets was involved in illicit activities in 2022. Therefore, a draft of ‘The Digital Asset Anti-Money Laundering Act’ was made, considering these warnings.

What does the Digital Asset Anti-Money Laundering Act of 2023 Say?

The main of the Digital Asset Anti-Money Laundering Act of 2023 is to address the regulatory gap and form a well-organized framework for governing digital assets. The key provisions of this act include:

1. Extension of Bank Secrecy Act (BSA) Responsibilities:

DAAMALA 2023 proposes extending BSA Act requirements. Providers, validators, miners, network participants & all other individuals involved in the validation or facilitation of digital assets transactions would have to undergo KYC (Know Your Customer) requirements.

2. Security on Unhosted Wallets:

The act extends the support to FinCEN (Financial Crimes Enforcement Network) for proposing a rule that allows banks & MSBs to verify customer identities. Moreover, FinCEN would look after file reports, and maintain every transactional report involving unhosted wallets.

3. Guidance on Digital Assets Handling:

The Digital Asset Anti-Money Laundering Act of 2023 would also allow FinCEN to guide all financial institutions on digital asset handling, usage, and transactions using anonymity-enhancing technologies.

4. Review Process of Digital Asset Entities:

The DAAMLA 2023 would elevate the BSA’s power by allowing the Department of Treasury to conduct the AML/CFT examination and review process for all digital asset entities and MSBs. Moreover, the SEC (Securities and Exchange Commission) and CFTC (Commodity Futures Trading Commission) would assist the Department of Treasury in implementing the powers.

5. Restrictions on the Payment to Foreign Bank Accounts:

If any US Citizen found transacting digital assets worth over $10,000 through offshore accounts, they have to file a report of FBAR (Foreign Bank and Financial Accounts) with the Internal Revenue Service.

6. Update of Physical Addresses of Every Digital Asset ATM Owner:

The act would allow FinCEN to ensure all digital asset ATM owners submit their physical addresses, along with KYC and other identifications.

What Claims Did the Chamber of Digital Commerce (CDC) Made on Senator Ms. Warren & Mr. Brown?

On February 20, 2024. The CDC moved to X (Formerly Twitter) and claimed Elizabeth Warren and Sherrod Brown were ‘Trying to Kill the Entire Industry’ through the Digital Asset Anti-Money Laundering Act.

Perianne Boring, Founder and CEO of ‘The Chamber of Digital Commerce’, also wrote a letter to Sherrod Brown, Chairman of the Senate Committee on Banking, Housing, & Urban Affairs.

Boring wrote in the letter,

‘This bill, if passed, will erase hundreds of billions of dollars in value for U.S. start-ups and decimate the savings of countless Americans invested in this asset class legally.’

Furthermore, he goes on to write,

“We must be clear: the decentralized nature of digital assets, when properly regulated, offers greater transparency and security than traditional systems, yet this bill ignores such potential. Moving this bill forward will have far-reaching consequences for economic and strategic interests alike.”

What’s Next?

The Senate Banking Committee is ready to reconsider this bill potentially. Therefore, we can expect possible hearings on it in the coming months. Deep down, everyone knows that passing the Digital Asset Anti-Money Laundering Act of 2023 would largely impact the entire digital assets industry, including the crypto landscape. Moreover, it’ll also be interesting to see how this act will impact Senator Warren and Brown as both are running for reelection in 2024 from Ohio and Massachusetts, respectively. We can also see a crypto war in the political landscape as John Deaton from the Republican Party (one of the most crypto-friendly politicians) is also running for election against Elizabeth Warren. So, stay tuned to get updates on Warren vs. Deaton news, too.