investing in cryptocurrency: Have you been trading in the cryptocurrency market? Do you want to boost liquidity while trading your preferred cryptocurrency?

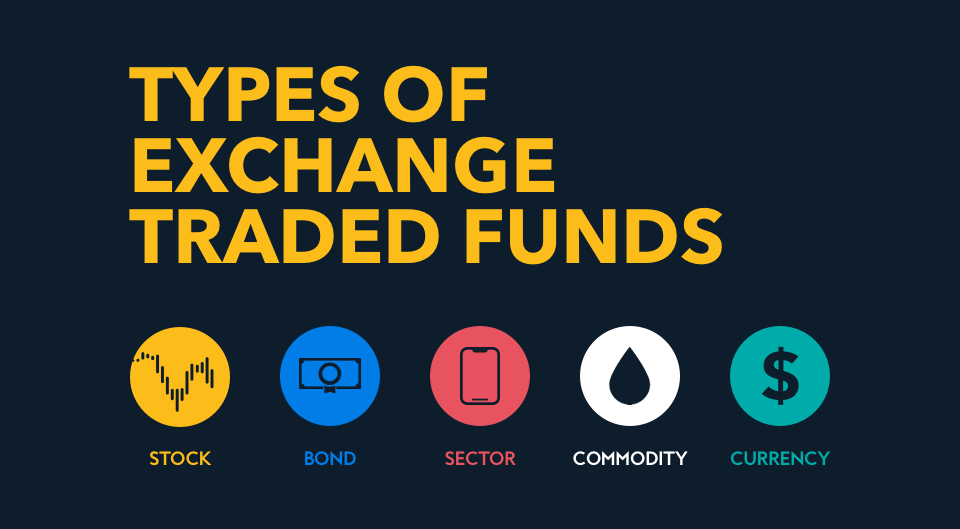

If so, you must start trading cryptocurrency ETFs (Exchange Traded Funds) right away. In this blog, let’s take a quick and comprehensive look at cryptocurrency ETFs.

Cryptocurrency ETFs: What Is It?

Just like regular stocks, Cryptocurrency ETFs are traded daily. These funds track the cryptocurrency price of one or more digital tokens. Just like regular stocks, the price of ETFs fluctuates based on changes in the cryptocurrency market.

Cryptocurrency ETFs: Two Kinds of Trading

- Cryptocurrency ETFs trading type I is backed by physical cryptocurrency. In this trading type, the investment firm will buy the cryptocurrency and represent the ownership of these cryptocurrency funds as shares. The investors can buy these shares and indirectly own cryptocurrency. The major benefit of such trading is that the investors don’t need to bear the risk and expenses of cryptocurrency.

- Cryptocurrency ETFs trading type II includes tracking cryptocurrency derivatives such as cryptocurrency ETPs (Exchange Traded products) and future contracts.

Cryptocurrency ETFs: Advantages to Investors!

The trading of cryptocurrency ETFs is definitely filled with uncertainty much like the cryptocurrency market. However, it provides major advantages to investors as compared to direct cryptocurrency trading. Here are a few that show that cryptocurrency ETFs trading is highly advantageous.

- The biggest advantage of cryptocurrency ETFs trading is that investors don’t need to tackle actual cryptocurrency. Investors don’t need to worry about direct expenses and risks associated with cryptocurrency. This is an important advantage, especially for beginner traders. All the expenses will be taken care of by ETFs providers.

- Cryptocurrency trading prices have increased exponentially in the past few years. This has made it impossible for an average investor to take advantage of this market. But with cryptocurrency ETFs, trading in this market becomes accessible to an average investor. If an investment is made wisely in cryptocurrency ETFs, the investor can gain significant profits over time.

- The cryptocurrency market seems unapproachable to several investors due to its technologically steeped jargon. Terms like blockchain, halving have deterred investors from learning about the market effectively. With cryptocurrency ETFs, the learning curve is left to analysts and investors don’t need to worry about the technicality of it all.

- Security has been the biggest question when it comes to cryptocurrency trading. There have been several instances where cryptocurrency wallets have been hacked. This has also kept several investors away from cryptocurrency trading. However, ETFs give a secure opportunity to investors for trading in this market. The security of ETFs is handled by the ETF provider making it a safer bet for investors.

- With more than 1,800 cryptocurrencies, it can become difficult to determine which cryptocurrency to trade in. Also, some cryptocurrencies are available on one cryptocurrency exchange whereas some aren’t. This also confuses investors and deters them from trading. However, with ETFs, the trading is more streamlined without extra trading costs.

Cryptocurrency ETFs: Bottom Line

Cryptocurrency ETFs are an exciting prospect for beginner and pro investors who want to explore this market. Without any extra expenses or complicated jargon and analysis, ETFs make it easier to trade in this volatile market.

So, if you still haven’t explored trading in the cryptocurrency market, start with cryptocurrency ETFs!

Keep reading more news, insights, guides about cryptocurrency trading on Coin Informer!