Bitcoin Hard Forks: Satoshi Nakamoto, the mysterious software developer released bitcoin in early 2009. This was the first cryptocurrency ever to be released. And since then, it has seen a massive following to grow as a cryptocurrency with the highest market capitalization.

Many new and pro investors strongly believe in bitcoin which is usually their first cryptocurrency to invest in. However, over the years, bitcoin has motivated other developers to release newer cryptocurrencies. Some cryptocurrencies have been made using the initial concept and program of bitcoin. Whereas some have made modifications to this basic program of bitcoin to generate newer cryptocurrencies.

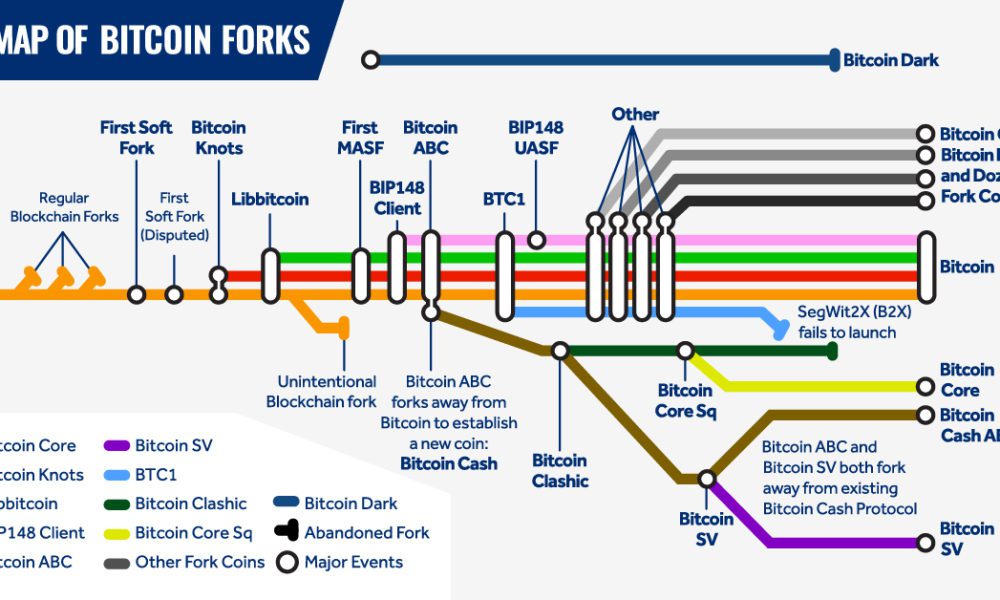

There are some cryptocurrencies that have been generated due to forking and creation of hard forks in the initial program. If you want to read about hard forks, you can read our previous blog on the same on our website.

Since the inception of bitcoin, there have been thousands of forking events however, only a few cryptocurrencies generated using forking are viable. Let’s take a look at the timeline of hard forks and viable cryptocurrencies.

- Bitcoin XT

Mike Hearn created bitcoin’s first notable hard fork in 2014 and generated Bitcoin XT. This new cryptocurrency had several new features such as 24 transactions per second as opposed to seven transactions. Also, the cryptocurrency had a block size of 8 megabytes as opposed to 1 megabyte.

Until 2015, Bitcoin XT saw growth with 1000 nodes running. However, it lost interest from initial investors and now Bitcoin XT is not available for investment and its website is also defunct.

- Bitcoin Classic

After Bitcoin XT was defunct, developers still wanted a cryptocurrency that has increased block size. So, they released Bitcoin Classic with a block size of two megabytes. Similar to Bitcoin XT, Bitcoin Classic saw initial interest in 2016 with 2000 nodes running. However, investors lost interest and moved to other viable options.

But some investors still favor the potential of Bitcoin Classic.

- Bitcoin Unlimited

2016 also saw the emergence of Bitcoin Unlimited. However, if you ask investors, they will say that this cryptocurrency is a huge mystery in terms of investment. Since the developers never specified the type of fork it will require. Also, the developers left it on miners to increase the block size but limited it to 16 megabytes.

Bitcoin Unlimited never got the traction as opposed to other cryptocurrencies. Investors lost interest and moved to other options.

- Segregated Witness

Segregated Witness was released in 2015 by Bitcoin core developer Pieter Wuille. Commonly known ad SegWit, the main aim was to reduce the size of bitcoin. This helped investors to carry a greater number of transactions.This is not a hard fork instead it is a soft fork.

- Bitcoin Cash

In response to the soft fork, bitcoin developers released a hard fork to generate Bitcoin Cash. This hard fork was meant to overcome protocol changes caused due to SegWit. The hard fork bifurcated from the original protocol in August 2017. As a result, bitcoin cash wallets rejected original bitcoin transactions.

Amongst all the hard forks to date, Bitcoin Cash has been the most successful. It is the 11th most traded cryptocurrency in the market. Bitcoin Cash allows a block size of eight megabytes and doesn’t adopt SegWit protocol.

- Bitcoin Gold

Over the years, the mining process started using complicated software and hardware. Therefore, certain developers thought that this might complicate the process of investment for novice or the one who had no tech background. Hence, they generated a hard fork in October 2017 to release Bitcoin Gold. This cryptocurrency can be mined using basic graphic processing units (GPUs).

Also, Bitcoin Gold has a process called “pre-mine”. In this process, the developers mined 100,000 coins before the cryptocurrency was released. The pre-mined coins were used for different purposes. Some coins were kept as “endowment” to develop and grow the Bitcoin Gold. Some coins were kept to pay developers for their time and expertise.

- SegWit2x

After SegWit, the developers intended to release another hard fork SegWit2x. This hard fork differed from SegWit in a way that it will initiate a block size of two megabytes and offer optional replay protection.

And this was the reason why several investors who backed SegWit opted out of SegWit2x. Thus, the release was eventually canceled.

Final Takeaway

Bitcoin hard forks have been happening since its inception. However only a few have gained the attention of investors. And out of those few only a few of them has stayed afloat. This will help you identify which hard forks are worth your attention and which aren’t.

To keep getting more insights like these, keep reading our blogs on Coin Informer!