Since Bitcoin’s introduction on the internet ten years ago, cryptocurrency trading has grown in popularity. Digital coinage, known as cryptocurrencies, is produced utilizing peer-to-peer networks or blockchain technology, which uses encryption to ensure their security. They are distinct from fiat currencies issued by governments worldwide because they are composed of bits and bytes of data rather than physical objects.

Additionally, no central body or authority, such as a central bank, issues cryptocurrencies or controls their circulation in the economy. Therefore, cryptocurrencies are not regarded as legal cash because they are not issued by any government entity.

Even though cryptocurrencies are not recognized as legal tender in the global economy, they have the potential to change the financial landscape, and this makes them hard to ignore. At the same time, blockchain technology, which forms the foundation of cryptocurrency creation, has opened up new investment opportunities for traders to capitalize on.

Factors That Determine Cryptocurrency Prices

Blockchain technology has larger economic ramifications than just laying the groundwork for cryptocurrencies, with potential uses in smart contracts and the Internet of Things, among other areas. Cryptocurrencies are not subject to the same market forces as conventional markets because they were recently launched in the previous ten years and are not regarded as legal cash. Therefore, trading cryptocurrency is different from trading on conventional financial markets.

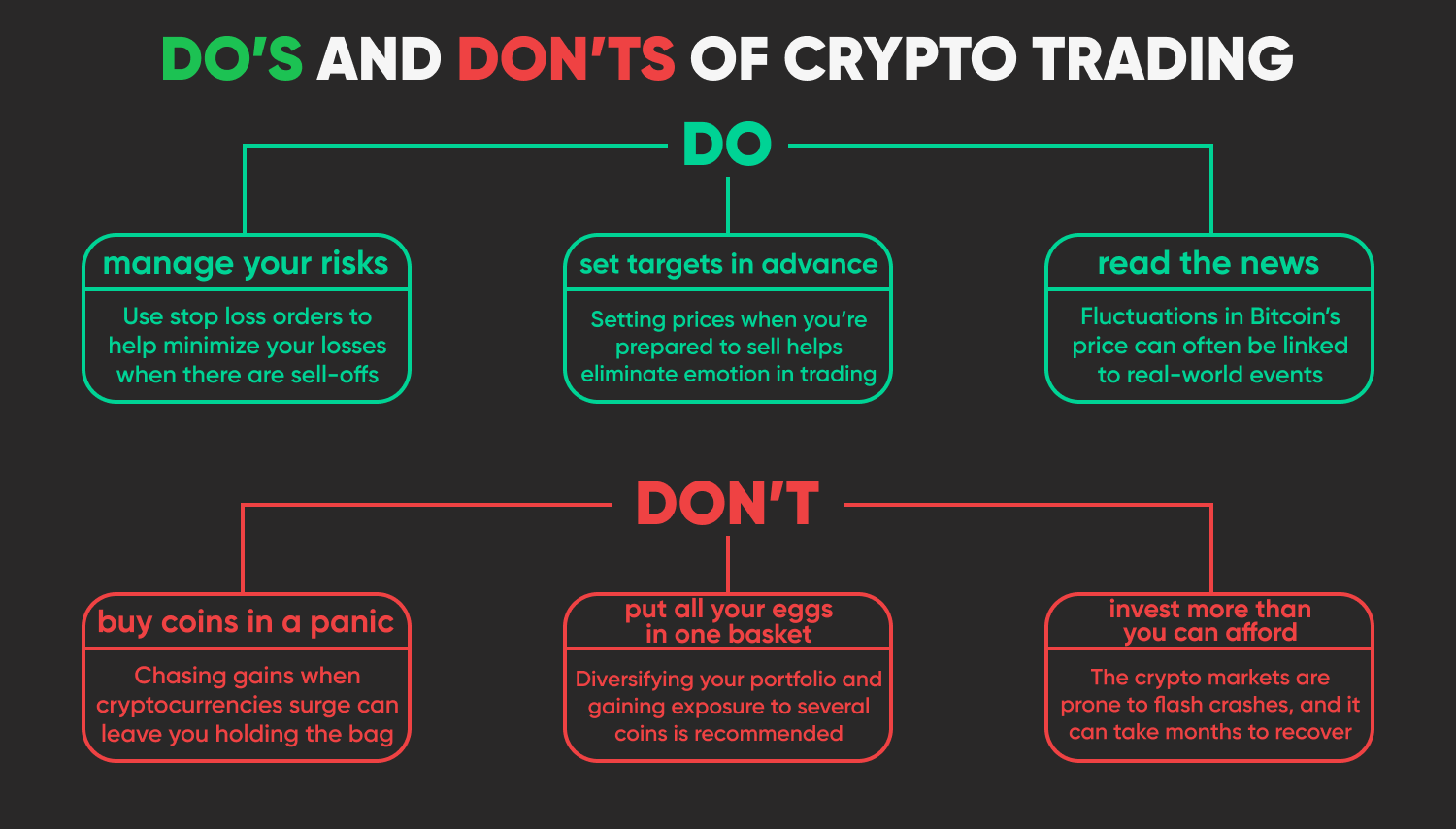

Because cryptocurrencies are decentralized, events like data releases, political unpredictability, and interest rate changes have less of an impact on their market swings. Additionally, because cryptocurrencies are a new class of financial instruments, there aren’t many correlated assets that could influence their price changes.

Nevertheless, a number of factors, including advancements in blockchain technology and legislative efforts to limit cryptocurrencies’ acceptance and “tradability” in the financial markets, can have an impact on their pricing. Its price may also be impacted by news stories on arguments over the best way to upgrade or process a specific coin. Any security holes discovered by hackers are likely to have a negative impact on a cryptocurrency’s valuation as well. Of course, the price of a cryptocurrency will also be impacted by any laws or rules that attempt to restrict or outright outlaw their selling.

Types of Cryptocurrencies

lthough there are hundreds of cryptocurrencies accessible right now, traders’ attention seems to be concentrated on about half a dozen of them. Bitcoin, which is recognized as the first cryptocurrency, is listed among the most widely used cryptocurrencies. Bitcoin split into two new additional virtual coins, Bitcoin Cash and Bitcoin Cash ABC, as a result of a “hard fork” in the original Bitcoin network. Ethereum and Litecoin are two more well-known cryptocurrencies that are widely traded on cryptocurrency exchanges and online CFD trading platforms.

Bitcoin (BTC)

The first cryptocurrency to be offered to the world was Bitcoin, or BTC, in 2008. Blockchain technology was initially implemented in this cryptocurrency. The value of Bitcoin has already surpassed even that, making it one of the valuable cryptocurrencies in the market.

Cash Bitcoin (BCH)

In August 2017, a hard fork on the original Bitcoin blockchain led to the creation of Bitcoin Cash. The modification was made in an effort to speed up transaction processing by allowing for longer blocks on the original network.

ABC of Bitcoin Cash (BAB)

the outcome of a second “hard fork,” this one is occurring on November 15, 2018, in the Bitcoin Cash blockchain. The Bitcoin Cash Adjustable Blocksize Cap (where the “ABC” comes from) wanted to implement an upgrade to the Bitcoin Cash blockchain software, which led to the hard fork. The biggest blockchain software client at the time was Bitcoin Cash Adjustable.

What Ways Are Cryptocurrencies Traded?

There are various ways to trade cryptocurrencies. The first method is to buy and sell the virtual currency itself on a cryptocurrency exchange. Using derivative financial instruments, such as Contracts for Difference (CFDs), which you can trade on the Plus500 platform, is another option to trade cryptocurrencies. The latter has gained a lot of popularity in recent years as it involves less capital outlay while at the same time enabling traders to speculate on the pricing movements of the cryptocurrency without having to actually own them.