Bitcoin has gained the massive spotlight in the past few years. In fact, 2021 was a breakthrough year for the bitcoin and cryptocurrency market overall.

However, several investors predict that bitcoin will crash in the next few years. If you are one of those investors, you might want to short bitcoin as soon as possible. However, before you short bitcoin, you must consider the following factors.

- Volatile Price

You might already know that bitcoin has a volatile price. However, when you short bitcoin, volatile prices will affect the results. Bitcoin shorting largely depends on derivatives. And these derivatives change based on bitcoin’s price. Any fluctuations in bitcoin’s price will affect these derivatives, thus causing a domino effect on investor profits and losses. For example, volatile prices of bitcoin increase the losses if you are using bitcoin options trading as a method of shorting the coin.

- Risky Asset

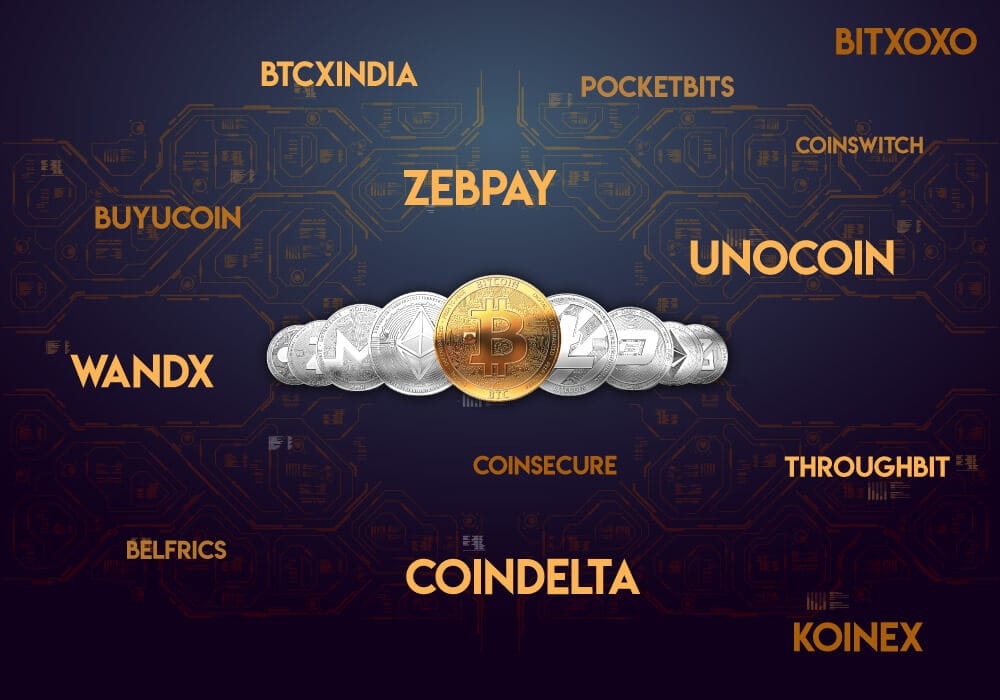

Bitcoin is considered an asset by several investors. However, this is another factor that you need to consider if you short bitcoin. You might ask why is such the case? The answer is simple. Bitcoin is still an emerging currency. Introduced in 2009, it has been only 13 years and investors don’t have enough data to rely on and consider it as a solid asset for investment. This also reduces the ability of investors to make an informed decision. Moreover, several cryptocurrency platforms are complicated and prone to hacks.

- Bitcoin Regulation

Cryptocurrency and in particular bitcoin have global recognition. However, the global regulation policy of bitcoin is still unclear. Each country has a different set of rules, and some countries are still debating the regulation of cryptocurrency and more. For example, there are several cryptocurrency platforms and exchanges that are not available in the US.

This lack of regulation has resulted in crypto exchanges providing offerings that might have been considered illegal under proper oversight. Hence, when you short bitcoin, make sure to consider the regulation in the country of residence.

- Learn About Order Types

Make sure to learn about order types before you short bitcoin. This is important to reduce your losses. What if the trajectory of bitcoin price doesn’t turn in your favor? What if it is different from your initial betting? In such a case, you will suffer huge losses. Hence, to avoid this, you need to learn about order types. For example, to reduce your losses, you can use stop-limit orders.

Final Takeaway

Bitcoin shorting is a way to make sure that you avoid losses if the prices crash. However, you need to be smart and consider a few factors to successfully short bitcoin.

Find out more about cryptocurrency news, guides, methods, strategies, reviews, and more on Coin Informer!