If you need accurate information about the crypto coin, then you are at the right place. Get the crypto coin update with the best website, Coin Informer. Today we will provide detailed information about the crypto market cycle, which typically consists of four different phases of price trends caused by several external factors.

What Does The Crypto Market Cycle Look Like?

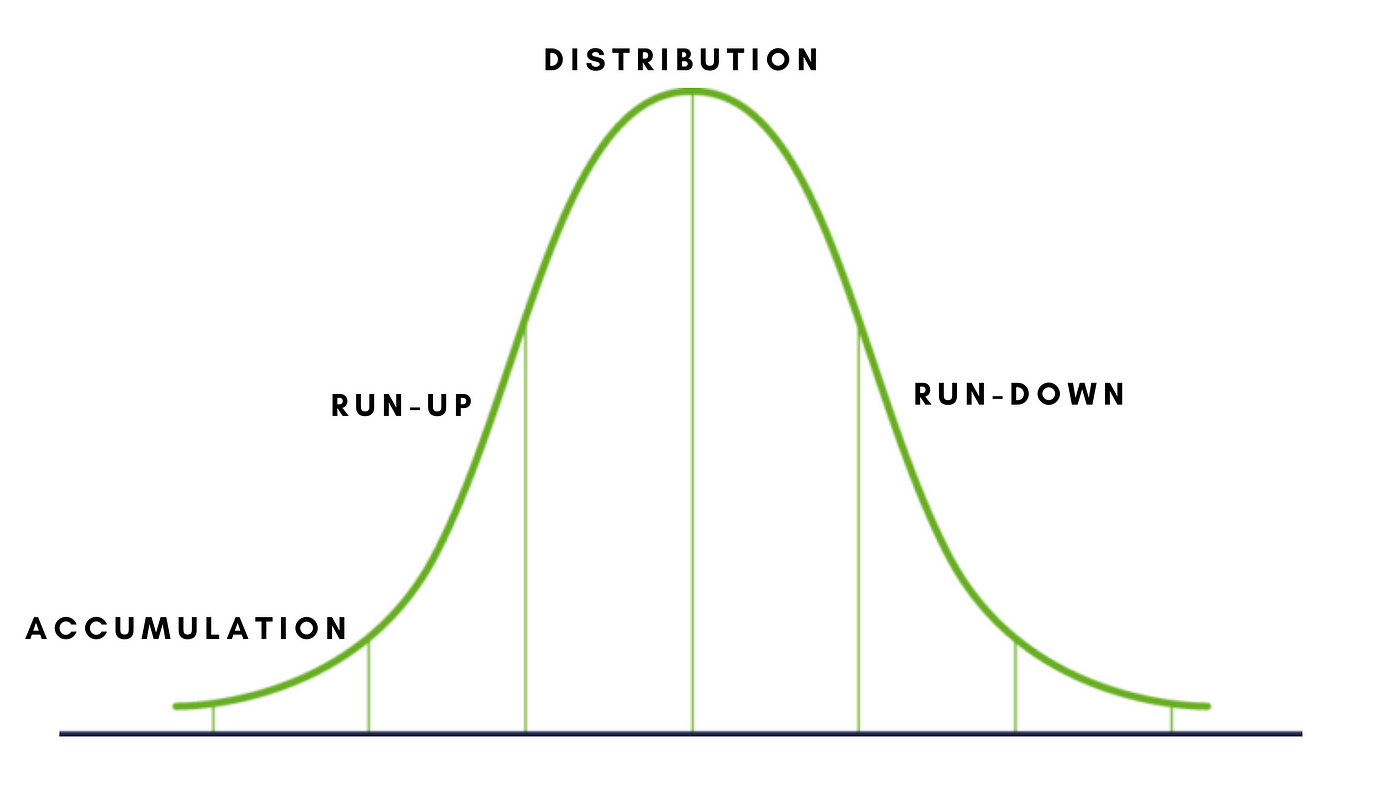

The Crypto market starts with little to no interest in the Market. However, as more interest develops, asset prices rise to keep up with increasing demand. Sometimes, prices reach a peak and eventually start decreasing. Therefore, before choosing cryptocurrency, it is essential to understand each stage that will help you participate in the Market in an informed way.

1. The Accumulation Phase

It is the very first phase of every market cycle. In this phase, the investors invest the funds in the cryptocurrency for a certain period and extract them when the accumulation matures. Many people contribute to the superannuation account to get the best value of deposits in the future.

Features

- Low trade volume

- Less price volatility

- Market sentiment depends on the supply of the crypto coin

2. The Markup Phase

During the markup phase, the crypto coin price breaks out of range and begins a sustained uptrend. An uptrend means a series of higher pivot highs and lows. In simple words, it means when the price starting begins moving up. That is why the phase is called the big bull phase. The demand for an asset began when the coin started making value in the Market.

Features

- Excitement and optimism

- Increase in the trade volume

- Favorable economic conditions

- An up-trending pivot chart

3. The Distribution Phase

At this phase, some buyers become sellers. It means they lock their crypto coin in profit. This creates tension between bulls and bears; the Market will see a high trading volume, and asset prices will fluctuate within a limited range. In the distribution phase, you will examine the relationship between the stock closing price and volume flow. Many marketers believe that the phrase is a very emotional time for the markets because you will get the maximum returns.

Features

- Elevated trading volume

- Low price volatility

- Don’t be greedy; hold the price when you think it is the right time.

4. Markdown Phase

The markdown phase is also called the bear market. For marketers, it is the scariest phase, and the supply exceeds the demand in the distribution phase. It is the last stage of the cryptocurrency market cycle. In some situations, the cascading effect can send the prices of an asset to levels. Therefore, the power of patience is required when you are planning to invest in cryptocurrency.

Features

- Unfavorable economic conditions

- Elevation trading volume

- Down trending price chart

- In the Market you might seem anxiety and panic conditions

In this period, every dream can give you trouble when you pull out an asset out of a downtrend. These are the information about the crypto cycle market so that you know how to invest the crypto coin in the Market.

Conclusion

Market cycles are easy to understand; all you need to read the above scenario carefully. With enough practice, you will be able to identify the potential signs of each individual in each stage. Investing in a cryptocurrency might involve less risk; all you have to do is use the mind with the latest crypto news. Reach out to Coin Informer; the website offers you the best cryptocurrency news and latest information such as what is happening in the Market, supply and demand about the cryptocurrency, tips, guides, and many more.