The dramatic growth of FTX and its founder, San Bankman-Freed (known as SBF), was nothing short of extraordinary. In just three years, FTX went from relatively unknown to becoming one of the world’s largest Cryptocurrency exchange platforms. They even had famous people supporting them. It was once considered the safest and easiest platform to buy and sell crypto. However, it was all the façade behind all the excitement and success. There was something fishy going on behind the scenes. It seems like they were misusing funds, which ultimately led to the catastrophic collapse of FTX. Let’s get into the aftermath of the trial and learn what is happening in the courtroom!

After the arrest of Sam Bankman Freed, the founder Sam Bankman-Freed (known as SBF), we all come to the conclusion that the cryptocurrency world isn’t as safe as it might seem. The billionaire founder of FTX, a prominent cryptocurrency exchange, faced charges of fraud and conspiracy following the catastrophic collapse of his platform in November 2022. This arrest marked a significant turning point in his journey, as he had rapidly risen to prominence with a net worth estimated at $26 billion.

The Trial:

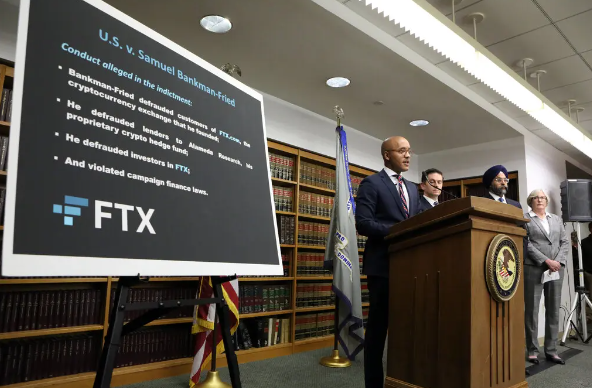

The main event in this story, the Sam Bankman-Fried’s Trial, is happening in Manhattan’s Courtroom. Where he faces prosecutors who are big names in financial crime cases and political corruption cases, a seasoned judge, and his former associates who are all ready to testify against him. The trial is expected to last up to six weeks. This trial is an important movement in the aftermath of FTX’s collapse.

The Defendant:

A 31-year-old Sam Bankman-Fried is currently on trial. He has already given his statement of not being guilty. He denies his involvement in fraud and conspiracy related to FTX. On the other hand, the prosecutors claim that he has used billions of dollars from FTX customers to cover losses at his cryptocurrency hedge fund, Alameda Research.

There is something in his story that has taken the interest of the majority of people in America, especially the investors. He is a graduate of the Massachusetts Institute of Technology (MIT) and made a lot of money through digital assets. He is even known as an influential personality in Washington, DC, as he has donated to U.S. political campaigns. It all ends with FTX going bankrupt.

The Prosecutors:

The group of lawyers prosecuting the case includes six members, with Danielle Sassoon and Nicolas Roos leading the way. Sassoon, a graduate of Yale Law School and a former clerk for late Supreme Court Justice Antonin Scalia, is notable for her prosecution of Lawrence Ray, who was convicted last year of sex trafficking and extortion involving New York college students.

Moving towards, Nicolas Roos, a graduate of Stanford Law School, is known for leading the prosecutions of Lev Parnas and Igor Fruman, former associates of Rudolph Giuliani, who were convicted of violating campaign finance laws. Roos also prosecuted Trevor Milton, the founder of Nikola Corp, who was convicted in 2022 for deceiving investors.

At last, we have Damian Williams, the U.S. Attorney for the Southern District of New York. His prosecutions of Bankman-Fried and other prominent figures in the cryptocurrency space, such as Alex Mashinsky of Celsius and Do Kwon of TerraLuna, have solidified his reputation as a leading figure in the regulation of digital assets.

The Defense Lawyers:

Mark Cohen and Christian Everdell, from the law firm Cohen & Gresser, are leading Sam Bankman-Fried’s trial defense. They are known for representing Ghislaine Maxwell, who was convicted in 2021 for her involvement in recruiting and grooming teenage girls for abuse by Jeffrey Epstein.

Mark Cohen, a former federal prosecutor in Brooklyn, has a history of representing individuals accused of financial wrongdoing. He previously defended Peter Black, who was found not liable in 2014 by a jury on insider trading charges brought by the U.S. Securities and Exchange Commission.

Talking about! Christian Everdell, while serving as a federal prosecutor in Manhattan. He prosecuted Arthur Budovsky, a co-founder of the digital currency firm Liberty Reserve. Who pleaded guilty in 2016 to helping cybercriminals launder money?

The Witnesses:

Three former members of Sam Bankman-Fried’s inner circle, including former Alameda chief executive Caroline Ellison, former FTX technology chief Gary Wang, and former FTX engineering chief Nishad Singh. These three are all set to testify against him as they have all pleaded guilty to fraud charges themselves.

Caroline Ellison, who was once romantically involved with Bankman-Fried, initially met him while they were both traders at Jane Street Capital. Despite her initial skepticism about cryptocurrency, she moved to Alameda and later joined the inner workings of his firm. Her personal writings, shared by Bankman-Fried with a New York Times reporter, revealed

Emotional struggles related to their breakup and the pressures of work just before FTX’s collapse.

The Judge:

U.S. District Judge Lewis Kaplan presides over this high-profile trial. Moreover, he has recently handled defamation lawsuits against former U.S. President Donald Trump and a sexual abuse lawsuit against Britain’s Prince Andrew.

Judge Kaplan is known for his no-nonsense demeanor in the courtroom. He took measures like restricting Bankman-Fried’s access to the Internet after prosecutors accused him of tampering with witnesses while on bail. In February, Kaplan even considered revoking Bankman-Fried’s bond despite no formal request from prosecutors, stating, “There may very well be probable cause to believe that he either committed or attempted to commit a federal felony while on release.”

Kaplan ultimately ordered Bankman-Fried’s detention in August after the sharing of Caroline Ellison’s personal writings with a reporter.

Wrapping up:

In conclusion, the Sam Bankman-Fried trial is an important part of revealing all the secrecy of FTX. It reveals the difficulties and questions in the cryptocurrency world, along with the legal and ethical concerns involved.