"ACHIEVING A YIELD OF 15% PER YEAR IS VERY POSSIBLE!"

HOW MUCH RETURN CAN YOU ACHIEVE WITH A VALUE-BASED INVESTMENT?

Let's look at the numbers!

Factually, equity investments are the highest-return type of investments.

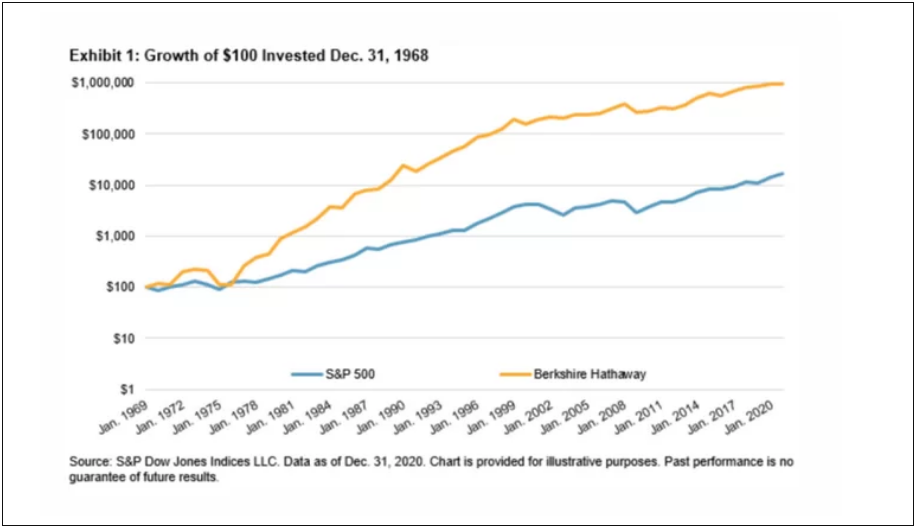

For instance, in the last 50 years, the S & P500 index, the stock index that brings together the 500 largest U.S. companies, has achieved a 9.7% return growth (including dividends).

If you could have invested $ 500 in the S&P500 50 years ago, which is $ 3,650 today, you would be about $ 51,200 rich. Such a tremendous amount, right? You mightn’t have invested $ 500 50 years ago because value-based investment education was rare, but here it is TODAY!!

Let's learn more!

A value-based investment of $ 500 in Warren Buffett’s company – Berkshire Hathaway, 50 years ago, gives an average return of 20.8%. Out of the $ 500, it would be $ 6.3 million.

Despite inflation being on an upward trajectory in America, 7.3-fold, you would have gained nearly 5.7 million USD

HOW DOES BUFFETT ACHIEVE AN AVERAGE ANNUAL YIELD OF 21% TO DATE?

HOW CAN YOU COPY THIS?

Dear Investor!

On Average, Warren Buffett has been raking an annual return of 21%, although 1953 -1993 were his jackpot years because he hit a 31% return on his investment.

The good news is that you don’t have to achieve the same results (unless your goal is to become the second richest man in the world).

Prosperity, and even wealth, requires only a fraction of that result! More precisely, just half, because with an annual return of 15%, nothing hinders you from being rich in about 20-30 years.

You can achieve a 15% return!

I’m Daniel Stein, and 12 years ago, investing in value-based investment was just a dream. I lived a decent but

struggling lifestyle, as my income and my wife’s income combined weren’t close to being enough.

I was constantly worried about how I was going to pay our bills. Once, I felt there was no way out of this squirrel wheel. But, I started analyzing how rich men conquered their financial obstacles, and that’s how I came across Warren Buffett and his Value-based investment strategy.

It can be called divine intervention, the hand of fate, or mere chance. But this encounter has turned my life 180 degrees.

Are you also looking for financial freedom and financial flexibility Read on!

I started my financial training 12 years ago. But for the past 8 years, I’ve dedicated my energy to studying Warren Buffett’s investment strategy. In September 2015, after thorough analysis and financial simulations, I bought my first stock.

I kept training and practising firsthand, strictly following Warren Buffett’s principles and strategy

I have seen my returns grow gradually, and my current return on my portfolio has averaged 27.71% over the past 5.5 years.

Today, I earn more from the return on my investment than from my work!

We have plenty of money invested and growing year by year, and I no longer worry about how I pay our bills. Failure to follow my indomitable will to share this knowledge feels like an unforgivable sin. I want to share it with as many people as possible, starting with you.

That's why you're reading this here now.

VALUE-BASED INVESTMENT IS A UNIQUE SAFE INVESTMENT STRATEGY

Over the last 50 years, there have been countless financial crises, small and large, whose repercussions are still visible around the world:

THE PAST DECADES HAVE NOT BEEN EASY...

The last few decades have beendifficult; Nevertheless, Warren Buffett’s company has achieved an average annual return of 21%.

I think that fact speaks for itself.

Think about it!

As prices rise year by year, the value of the money you originally invested or kept in cash decreases. If inflation is higher, this process will be more spectacular. Don’t let your hard-earned invested money be eaten up by inflation!

Know, understand, and start using the SAFEST and HIGHEST-yielding investment method used by Warren Buffett today. Be a student of the world’s most recognized and best investor by utilizing tested, easy-to-use techniques and principles that you can master in 55 years or less. He became one of the wealthiest people in the world

Get an annual average return of 21% and some capital!

BUT WHY DOESN'T HE EVER SHARE IF IT'S SO GOOD?

Warren Buffett speaks and writes openly about his knowledge and skills as an investor, learning the basics from his university professors – Ben Graham and Dave Dodd. If you read Berkshire Hathaway’s letters to shareholders from 1965 to the present day (this corresponds to several volumes of books in English), the secret is no longer a secret.

Several world-renowned entrepreneurs have followed this knowledge and experience of value-based investing and gained significant wealth.

But, if the secret is no longer a secret and it works so well, then why doesn’t everyone do that?

Warren Buffett once said:

“… The secret is no longer a secret, yet I haven’t seen any trend in the last 35 years that has suggested a breakthrough in value-based investment. There seems to be some perverted human trait that likes to complicate simple things. And in education, value-based investment has been explicitly pushed into the background for the past 30 years. This trend is likely to continue to be the case in the future.”

WHAT IS WARREN BUFFETT'S SECRET? AND HOW DID HE ACHIEVE SUCH EXCEPTIONAL RESULTS IN 50 YEARS?

We only need to achieve just 15% annual returns for prosperity if we understand exactly how he gained 31% a year for 40 years.

Okay. Guess how many stocks Buffett’s portfolio consisted of in 1989, 25 years after he started investing?

Helps: Most investment portfolios consist of more than 1,000 stocks.

How many shares did Buffett have?

Because this is the SECRET. This is the alpha and omega of your success.

In 1989, Buffett had a total of 5 stocks in his portfolio.

A total of 5 shares… in 25 years… This is an average of 1 new share every 5 years! The portfolio was valued at $ 5.188 million.

So: There were only few stocks in his portfolio, 25 years after the start!

It was true that there were also some 100% privately acquired companies already in Berkshire Hathaway’s portfolio at the time, but the equity portfolio consisted of only 5 shares.

BUFFETT HAS NO GOOD OPINION ON DIVERSIFICATION AND MODERN INVESTMENT MODELS - HE FOCUSES ON

A scientifically and financially proven 18-years study at the University of Standford has shown that less is more when it comes to investing.

The researchers examined portfolios of different amounts of shares randomly for a given period.

Research has shown that the fewer stocks in a portfolio, the more likely it is to achieve higher returns.

The 15-share portfolios outperformed the 15, 50, 100, and 200-share portfolios. Buffett always says, Don’t buy more than ten kinds of shares in your entire life!

Just put your money on an excellent company!

In Buffett’s words, “There are 3 excellent investment opportunities in your entire life that can make you rich.“

If you know that an individual can sell a company at a 30-50% lower price than its worth, you will concentrate on your capital. This also means that you may want to learn more about focused value-based investing, even if you have little money, because that’s what it entails; buying cheap and waiting.

You don’t have to buy into 100, 200 or 1000 different stocks. It is enough to concentrate your capital on 1-2 excellent stocks because you have a much higher chance of having a return above the market average.

So your little money will be a lot of money in a few years, and you can forget about worrying about finances for a lifetime.

Instead, you can enjoy the peace of mind of financial security. Although you may still not believe me, anyone can learn that. YOU TOO!

They are currently achieving the “IMPOSSIBLE”.

Warren Buffett’s focused investment strategy is a replica of when a hunter looks for an opportunity in advance. When it comes, you invest a portion of your capital based on an exact calculation formula, as you will learn from the Warren Buffett Crisis Strategy seminar.

Warren Buffett’s secret is; never to rely on chance when investing. This made him one of the largest and most respected investors globally. You just have to “copy” it all.

NO PRIOR KNOWLEDGE OR SPECIAL SKILLS REQUIRED

YOU GET THE FOUNDATIONS OF BUFFETT'S FULL METHOD - THIS IS THE MOST VALUABLE KNOWLEDGE THAT PAYS VERY WELL

You can put this knowledge into practice immediately. With this body of knowledge, you can make many millions and build wealth over the years.